FAQ

-

Q1. Is Japan Investment Corporation (JIC) a government-owned company?

-

A1.

Japan Investment Corporation (JIC) is an investment company, one of the public-private funds established in September 2018 under the Industrial Competitiveness Enhancement Act to help realize the policy objective of strengthening industrial competitiveness through open innovation and increasing private investment. JIC was established with JPY367 billion from the government and JPY13.5 billion from private companies.

-

-

Q2. What is the relationship between Japan Investment Corporation (JIC) and Innovation Network Corporation of Japan (currently INCJ, Ltd.)?

-

A2.

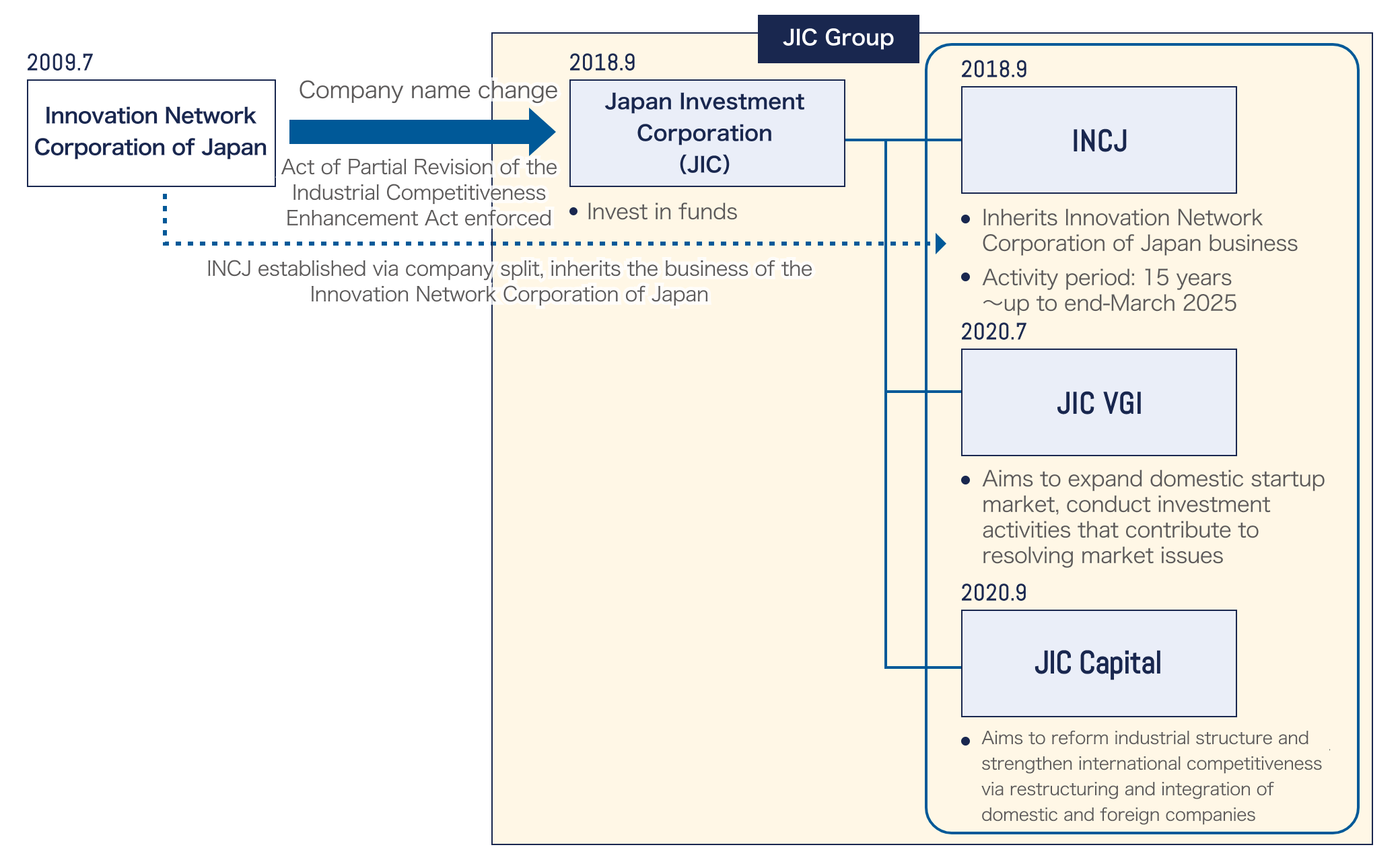

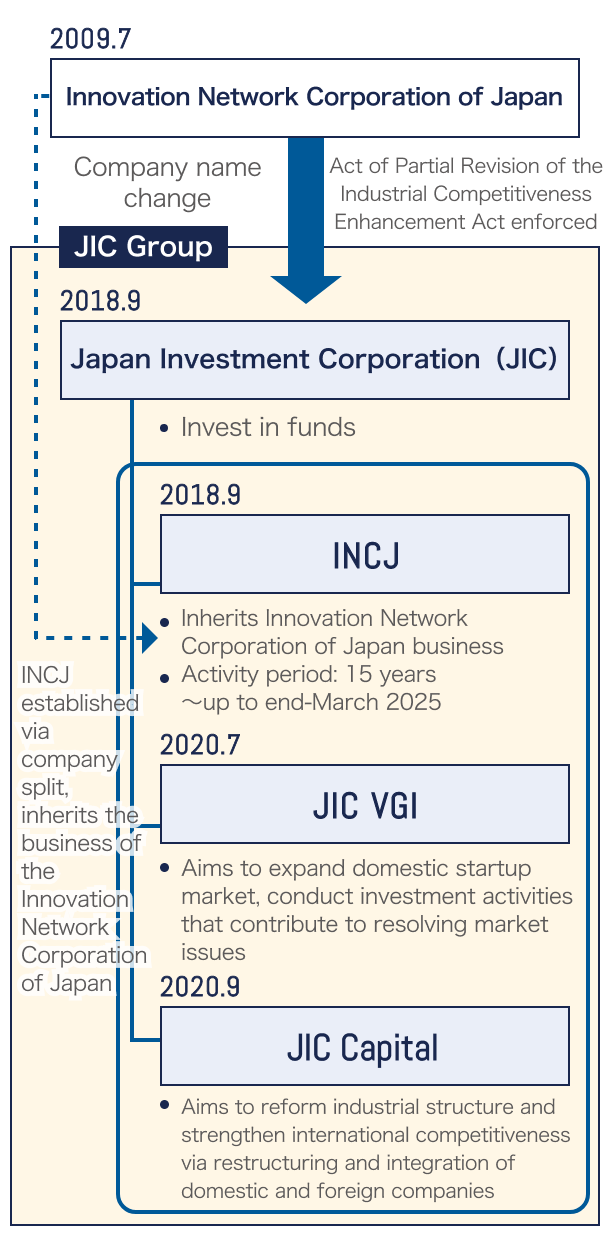

Innovation Network Corporation of Japan was established in July 2009 under the Act on Special Measures Concerning Revitalization of Industry and Innovation in Industrial Activities to foster and create the next generation of national wealth through open innovation, transcending industrial and organizational barriers.

In September 2018, INCJ, Ltd. (newly established and split off from Innovation Network Corporation of Japan) was established as a group company of Japan Investment Corporation (which changed its name from Innovation Network Corporation of Japan). INCJ took over the business of Innovation Network Corporation of Japan.

In July 2020, JIC established JIC Venture Growth Investments Co., Ltd. to invest in startups, and in September of the same year, established JIC Capital, Ltd. to make investments to promote business restructuring.

-

-

Q3. What are JIC's financial resources?

-

A3.

JIC operates using investments from the private sector and government funds (fiscal investment and loans, government-guaranteed borrowing facilities) as financial resources.

Fiscal Investment and Loan Program (FILP) is a government fund that is funded by capital raised through the issuance of FILP bonds, a type of government bond, and other sources.

The government-guaranteed borrowing facility is a facility under which the government guarantees the payment of principal and interest when a corporation or other entity engaged in highly public services issues bonds or borrows money. JIC has a government-guaranteed borrowing facility of JPY2.4495 trillion under the FY2025 budget.

-

-

Q4. How does JIC make investment decisions?

-

A4.

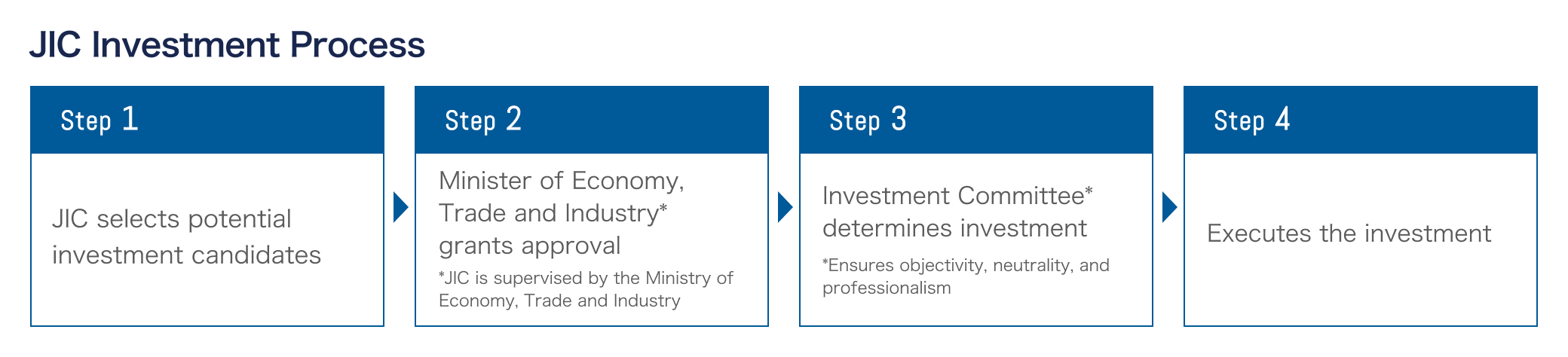

JIC internally selects potential investment targets that can both resolve policy issues and achieve profitability in accordance with investment criteria based on the Industrial Competitiveness Enhancement Act. Upon approval by the Minister of Economy, Trade and Industry, the Investment Committee, composed of outside directors and other members, makes a decision on the investment in the potential investee and then executes the investment.

-

-

Q5. How do we request an investment from JIC?

-

A5.

JIC group companies are primarily engaged in the following investment activities; please contact the company relevant to the type of investment:

JIC: Invests in funds as an LP

JIC Venture Growth Investments: Invests in startups

JIC Capital: Invests in business restructuring, etc.

(INCJ's operational mandate expires at the end March 2025; it is no longer accepting new investments)

-

For all other questions, please submit your inquiry to: info114@j-ic.co.jp