TOPICS

Startup

Startup

Nurture Global Unicorns

From Dormant Local

Technological Seeds

Part2

Japan Investment Corporation (JIC) seeks to create a virtuous circle of risk capital by providing risk capital to areas that are difficult for the private sector alone to support through investment, and by serving as a catalyst for private investment funds. Toshiyuki Kumura, CIO of JIC, and Yuka Hata, Head of Fund Investments, talk about the startup and deep tech ecosystem and the challenges and prospects for industry-academia collaboration with Tsuyoshi Ito, President of Beyond Next Ventures Inc., JIC’s first LP investment in a private fund.

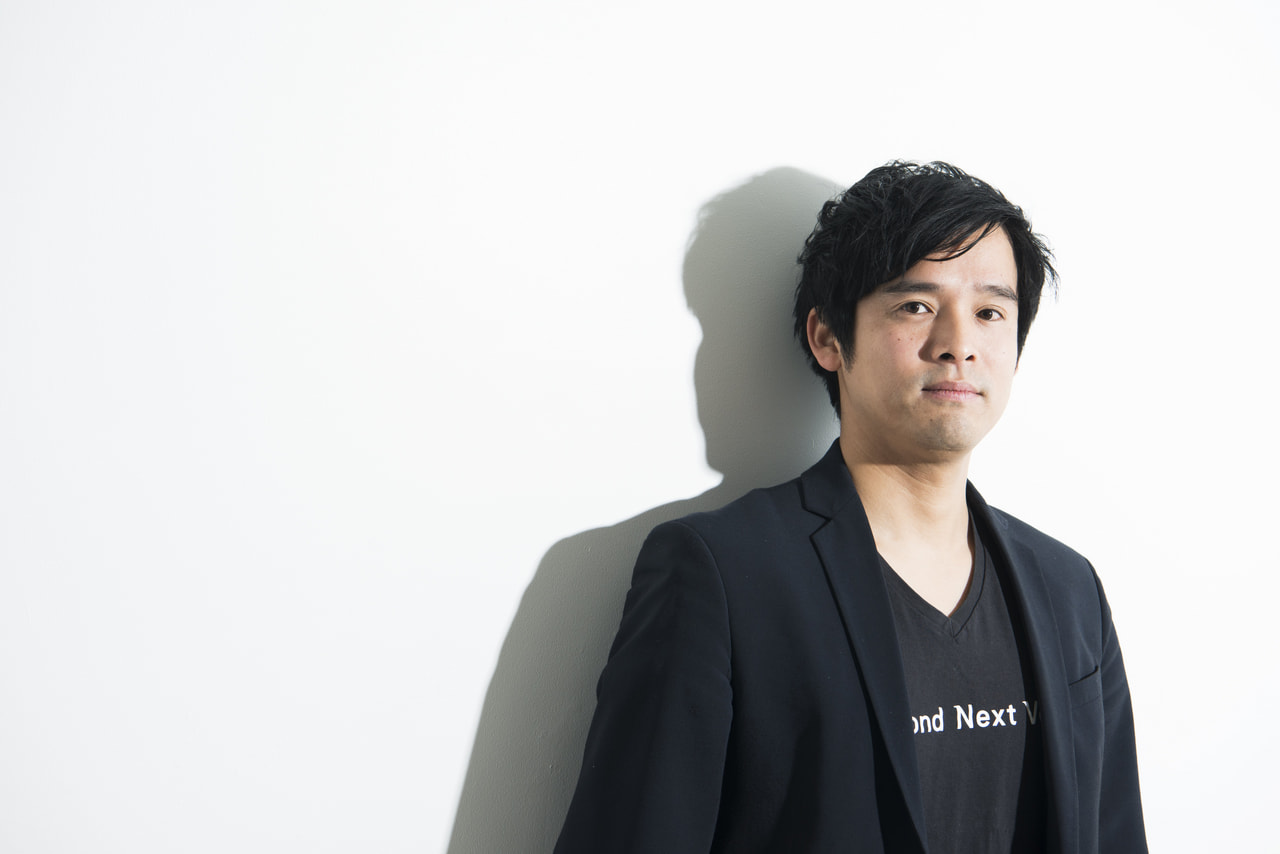

Tsuyoshi Ito

President, Beyond Next Ventures Inc.

In August 2014, Ito founded Beyond Next Ventures Inc. and became its president. Currently serves as an outside director of several portfolio companies, as well as a visiting associate professor at Nagoya University and Hiroshima University. He has served on startup-related committees and juries for the Cabinet Office and various ministries and agencies.

Toshiyuki Kumura

Member of the Board, Chief Investment Officer, Japan Investment Corporation

Kumura joined Tokio Marine & Fire Insurance Co. in 1983. After working in the Investment Department’s Alternative Investment Group, in 2002 he became Head of private equity unit at Tokio Marine Asset Management, Inc.; current position from 2019.

Yuka Hata

Head of Fund Investments, Japan Investment Corporation

Hata has played a central role in the field of private equity investment in Japan and abroad at Nissay Asset Management, Nomura Asset Management, and Nomura Private Equity Capital (NPEC); current position from 2020.Support Needed for Global Expansion of Domestic Startups

—Collaboration Among Domestic VCs to Involve Foreign VCs in Japan’s Ecosystem

Hata Compared to overseas ecosystems in the deep tech sector, what do you think Japan lacks in terms of creating frameworks, etc.?

Ito Although the environment for fundraising at the seed/early stages has been established, we feel that the scale of domestic investors is still insufficient to sustain an environment for raising funds in the billions of yen range, which is required when a company moves up in stage. For example, it would be good to see more global activities, such as the expansion and diversification of the size of domestic VC funds, startups raising funds from overseas investors, or existing VC shareholders supporting fundraising from overseas investors.

Kumura In a technology development startup, do they have a global perspective on the problem you are trying to solve?

Ito You hit the nail on the head. Many startups in the deep tech field have technology-oriented products, and these are common worldwide. As a result, we are confident about expanding these businesses globally.

Kumura JIC is also aware of the problem of having to support the global expansion of domestic startups. At the same time, startups in the deep tech sector will need to leverage foreign funding to cross the so-called “valley of death.” If entrepreneurs are thinking globally, then it would be good to see domestic VCs also provide support from a global perspective by promoting collaborations that involve overseas VCs.

Hata What are your thoughts on collaboration between VC funds and PE funds?

BNV making investments in India

Ito A portfolio company nearing the later stage in our No. 1 fund is in the process of raising capital from an overseas PE fund. In the deep-tech area, we feel it is important to seamlessly connect with PE funds and other unconventional sources of funding because, in some cases, external funding of several tens of billions of yen is required to develop a product, implement it in society, and make it profitable as a business.

—JIC: Being a Good Partner, Not Just a Provider of Funds

Kumura JIC makes LP investments in private funds based on three perspectives: first, whether they are consistent with policy objectives; second, whether they are in areas lacking private funding; and third, general investment evaluation criteria. In addition, we also ask our portfolio funds to meet investment criteria such as innovation, growth potential, and ability to exit. We are different from private LP investors, and I imagine there were both expectations and concerns about JIC’s participation in the No. 2 fund. A little over a year has passed since the investment—what are your impressions?

Ito Since JIC’s investment, we feel that we have grown in three areas. These are in regards to the partnership agreement, reporting to LPs, and the valuation of portfolio company assets. We’ve learned the proper way to report to LPs, and thanks to JIC’s support, we’ve been able to bring the contractual content of our partnership agreement closer to global standards. We’ve received a variety of suggestions regarding reporting, and I believe that we are building a system that will be able to withstand the challenge of seeking funds from overseas institutional investors in the future. How we value the assets of our portfolio companies in financial statements is important, but we’ve also received advice on process and governance, which has helped us to grow.

Hata Thank you for the great feedback. JIC’s goal has been to think together and solve problems together, including those related to contractual relationships and fund management, in order to attract funding from institutional investors. We are very happy to see that BNV is growing so much.

Kumura You will be starting your next fund shortly. In terms of providing a larger supply of capital, do you intend to work with domestic institutional investors?

Ito While we continue to focus on achieving solid performances from the No. 1 and No. 2 funds, we also aim to launch the next fund by the end of 2022 at the earliest. We are pursuing a scale that will allow us to provide continuous support to deep tech startups from the seed stage, and we hope to grow in size while providing credit based on the performance of the No. 1 and No. 2 funds so that we can gain the support of institutional investors in Japan and overseas.

Kumura The No. 2 fund is making good progress in its investment activities and expanding its team, and we hope that the forthcoming No. 3 fund will include institutional investors and, if possible, foreign funds to further expand the LP network.

Hata JIC would like to be a good partner as an LP, not just a provider of funds, so we would like to work together on the next fund’s structure and other concepts.

Expanding the Circle of Cooperation and Revitalizing Industry-Academia Collaboration

—Creating Global Unicorns in Deep Tech

Kumura There are only a limited number of places in Japan that are looking at industry-academia collaboration in general, and we are discussing the possibility of JIC playing a role as an investment hub, so we would appreciate the wisdom of Mr. Ito, who is well versed in the field.

Ito Local universities are looking to collaborate with BNV. This is because they have limited experience in supporting academia-launched ventures other than in terms of funding, and because of the limited number of funds that can be formed through local funding. Through this kind of collaboration, BNV can provide financial and human resources for commercialization of seeds that are lying dormant at local universities, and we feel that we can revitalize industry-academia collaboration in local areas. We look forward to working with JIC as well.

Hata I realized once again that what BNV is trying to achieve and what JIC is trying to achieve are firmly aligned. We hope to deepen the collaboration between JIC and BNV and expand it to other funds responsible for industry-academia partnerships with an eye on the larger goal of creating global companies from deep tech or creating global unicorns. We look forward to continuing to work with you as a good partner.